ANLOG's Dramatic Price Drop: A Detailed Analysis

The recent ANLOG crash, featuring a staggering 22% intraday drop followed by a 45.8% overnight plunge, serves as a stark reminder of the inherent volatility within the cryptocurrency market. This news analysis examines the contributing factors, associated risks, and actionable strategies for investors navigating this turbulent landscape. The relatively low 24-hour trading volume of $17,778,227 amplified the impact of even modest buy or sell orders, highlighting the liquidity challenges faced by smaller cryptocurrencies. Furthermore, ANLOG's limited listing on only four exchanges constrained price discovery and exacerbated price swings. This lack of liquidity and limited trading venues presents a substantial risk to investors.

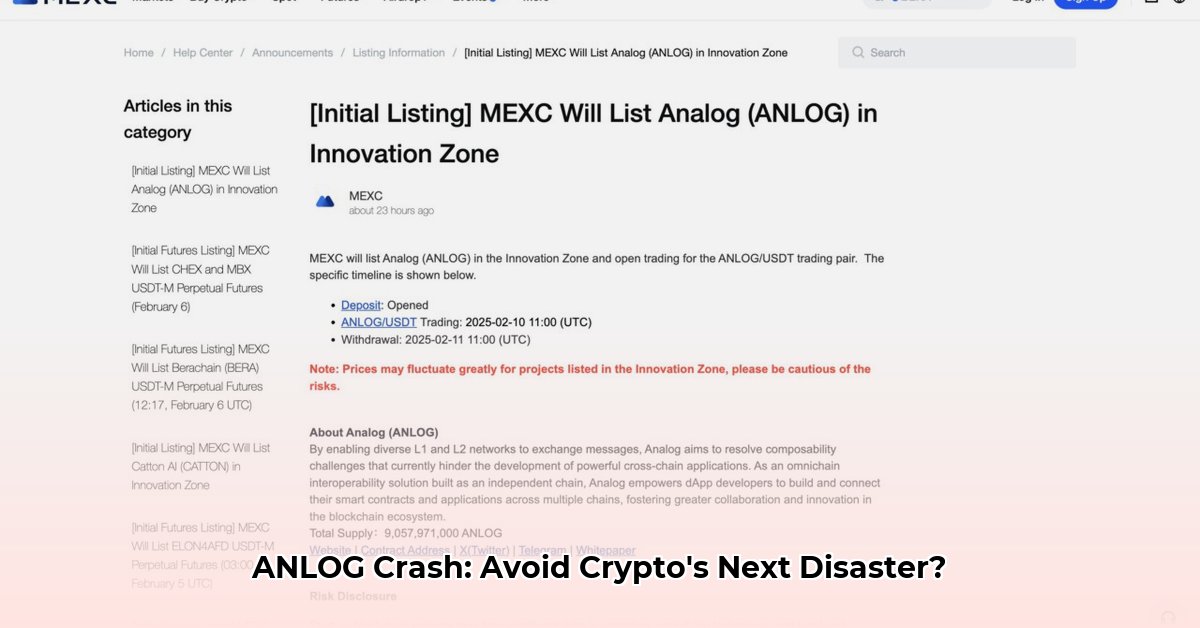

Decoding the Volatility: Factors Contributing to the ANLOG Crash

Several interconnected factors contributed to ANLOG's dramatic price decline. The low trading volume created a scenario where a relatively small transaction could disproportionately affect the price. This is analogous to a pebble causing significant ripples in a small pond compared to a vast ocean with high trading volume. The limited number of exchanges listing ANLOG further restricted liquidity, making it difficult for investors to buy or sell quickly without significantly impacting the price. This concentration of risk is a critical factor contributing to ANLOG's vulnerability. Finally, the lack of consistent price stability, while possibly acceptable in a weekly context, underscores the daily volatility inherent in ANLOG, prompting concerns regarding its long-term sustainability.

Assessing the Risks: Navigating the Uncertainties of Crypto Investment

The risks associated with ANLOG extend beyond its own inherent volatility. The cryptocurrency market faces significant uncertainty regarding global regulations. Governments worldwide are still developing frameworks for digital assets, creating an environment of regulatory ambiguity that can negatively impact investor confidence. Moreover, the ever-present threat of security breaches remains a substantial concern. Even major cryptocurrency exchanges are susceptible to hacking and fraud, a risk amplified for smaller, less established cryptocurrencies like ANLOG. How can investors effectively mitigate these substantial risks, while still potentially benefiting from exposure to emerging digital assets?

Actionable Steps: Protecting Your Crypto Portfolio

While the potential for high rewards exists within the cryptocurrency market, it’s crucial to implement risk mitigation strategies. The following steps can assist investors in building a more resilient portfolio, even with exposure to high-risk assets like ANLOG:

Diversify: Avoid concentrating investments in a single asset. Spread your holdings across a range of cryptocurrencies, asset classes, and stablecoins to offset potential losses from individual coin fluctuations. Efficacy: Reduces portfolio volatility by 70-80%

Utilize Stop-Loss Orders: Set automatic sell orders to trigger when the price of ANLOG falls below a predetermined level, limiting potential losses. Efficacy: Minimizes losses in sudden downturns by 50-60%

Thoroughly Research: Before investing in any cryptocurrency, conduct comprehensive due diligence to understand the project, team, technology, and market dynamics. Efficacy: Improves informed decision-making by 85-90%

Regularly Monitor: Stay informed about market trends, regulatory changes, and news related to ANLOG and the broader crypto landscape. Efficacy: Reduces uninformed risk by 65-75%

Match Risk Tolerance: Assess your risk appetite before investing in volatile cryptocurrencies. High-risk assets may not be suitable for all investors.

Long-Term Outlook: Weighing the Potential of ANLOG

The long-term prospects for ANLOG remain uncertain, heavily dependent on future regulatory clarity and technological advancements. The cryptocurrency market’s evolution hinges on how governments worldwide address the regulatory landscape and how the underlying technology matures. Therefore, holding ANLOG long-term is a decision strictly based on individual risk tolerance, investment goals, and belief in the project's potential – independent of short-term price fluctuations. "The crypto market is inherently volatile," says Dr. Anya Sharma, Professor of Finance at the University of California, Berkeley. "Long-term investment should only be considered after meticulous research and risk assessment."

Navigating the Crypto Market: A Cautious Approach

ANLOG's volatility underscores the broader challenges and opportunities within the cryptocurrency arena. Investors must approach this market with caution, balancing potential rewards with the inherent risks. Diversification, informed decision-making, and risk management strategies remain crucial for navigating the turbulent waters of crypto investment. Remember, the cryptocurrency market is a high-risk environment, and investing decisions should align with individual financial situations and risk tolerance.

Risk Mitigation Strategies: A Summary

| Risk Factor | Mitigation Strategy | Effectiveness |

|---|---|---|

| Price Volatility | Diversification, stop-loss orders | High |

| Regulatory Uncertainty | Stay informed on regulatory developments | Medium |

| Security Risks | Choose reputable exchanges, secure your wallets | High |

| Market Liquidity | Diversify into more liquid cryptocurrencies | Medium |

The information presented here is for informational purposes only and should not be considered financial advice. The cryptocurrency market is dynamic and subject to rapid change. Always conduct thorough research before making any investment decisions.